When you first launched your startup, it was probably exclusively yours and your co-founder(s). But as you fundraise, you give up equity in exchange for the money you need. To make it easy to keep a clear eye on what’s going on with any shareholder’s equity, including yours, you’ll need to use a tool called a capitalization table — or cap table, for short.

In the beginning, a cap table is usually a pretty straightforward spreadsheet. Excel or Google Sheets might do the trick. But as you land new investors or grant equity to employees, things get more complicated. Fortunately, a good understanding of capitalization tables will help along the way.

And that’s precisely why we’re here. Let’s look at cap tables, why they matter, and how to build one that can scale with your startup.

Cap table 101

A capitalization table is a document that lays out who has equity in your company, how much they have, and other key details (like share grant prices and whether stock is preferred or common). It’s basically a breakdown of your company’s ownership.

Startups need a cap table because it gives them a way to keep their investors organized. At the same time, it tracks equity grants you issue to employees (i.e., employee stock options). As you can probably guess, that means that your cap table grows and gets more complex over time.

Let’s say you founded a tech startup with a friend, and you agree to own equal shares of the company. At that point, your cap table is pretty simple. It shows you and the co-founder, each with 50% ownership.

With each fundraising round, though, the cap table gets more complex. As you add investors, your cap table needs to reflect how many shares they have, the type of share (common vs. preferred), and how that translates into ownership. Let’s say your startup now has three investors, each with 50,000 shares, with you and your co-founder having 100,000 shares. With 350,000 shares issued overall, you and your co-founder now each have roughly 28% ownership, while your investors each own about 14% of the company.

With that single round of fundraising, your ownership shrunk by nearly half. A cap table gives you a way to keep an eye on that metric, helping you to ensure your ownership never gets so diluted that you lose control over your company.

Note that while your startup is a private company, this isn’t a public document. It’s something you use internally for tracking and decision-making purposes.

Quick aside: common vs. preferred stock

Your cap table should also denote whether the shares issued are common stock or preferred stock. Preferred stockholders get priority over common stockholders when your company is issuing dividends, but common stockholders have voting rights. When you buy shares from a publicly traded company on a trading platform, you’re generally buying common stock.

Startups usually issue preferred shares to investors and common shares to founders and employees.

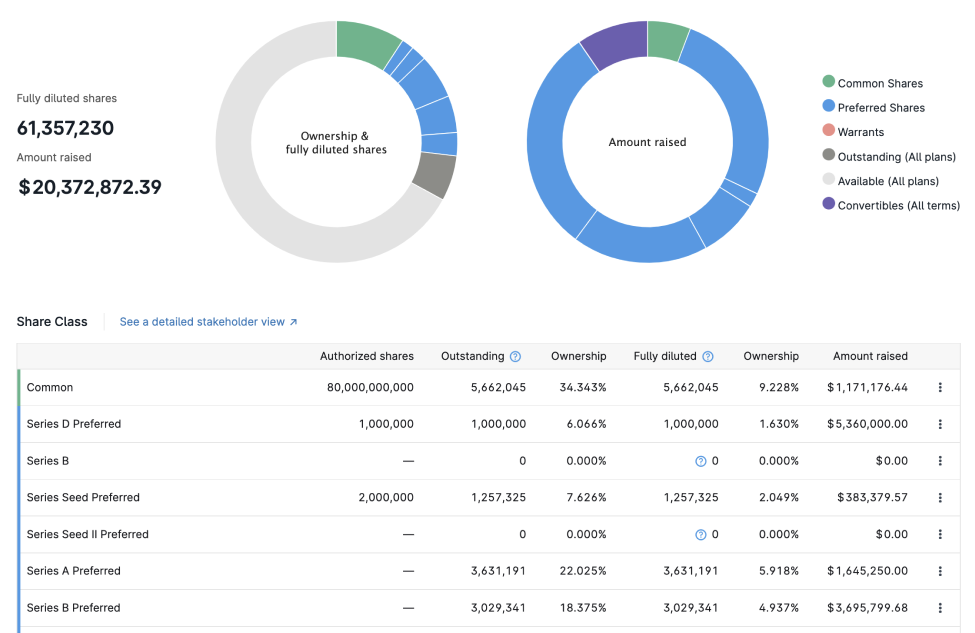

Sample Cap Table courtesy of Carta

Why you need a cap table

A cap table serves you in a number of ways. Here are three specific gains you’ll get by keeping an updated, accurate capitalization table through every stage of your startup’s growth:

For clarity as your startup grows

Your cap table drops a pin in the current moment, so you have a solid starting point from which to make decisions. You can use it to:

- Price future fundraising rounds

- Evaluate your ownership dilution

- Assess who has decision-making power at your company

- Determine when to grant equity to employees and how much to grant

Without a cap table, you risk giving away too much of your company in exchange for too little.

This will always be a balancing act for founders. You’d rather have a smaller stake in a company that’s worth a lot than a sizable stake in one worth little. Your capitalization table helps you to find the middle ground where you’re bringing in the money your startup needs to scale while also protecting your control of your business.

For your financial statements and reporting

On the accounting side, when we’re preparing a startup’s financial statements, we need to make sure that the cap table is accurately reflected on their balance sheet. Specifically, your cap table needs to reconcile to your balance sheet and other financial statements.

Your financial statements don’t necessarily need to list out every investor, but you do, at the very least, need a summary of the common and preferred stock that was issued.

As accountants, we also use cap tables to understand who owns how much of the company. This matters because certain levels and types of ownership come with specific reporting requirements. If a company that’s located abroad purchases a large stake in your startup, for example, you’ll need to disclose that on your tax return. Your cap table allows us to see that so we can make sure you’re compliant with relevant regulations, helping you avoid penalties. See our guide that goes over the tax disclosures that founders with cross-border implications need to know about.

For your current and prospective investors

Potential investors will likely want to see your cap table as they do due diligence. This allows them to see not just what their piece of the pie looks like but also who they’ll be climbing into bed with should they allocate funding to your company.

Investors you’ve already landed will likely want periodic cap table updates, too, to see how their ownership share is diluted with each round of funding.

The main players in cap tables

As we mentioned before, cap tables start out relatively simple. But they ramp up quickly, and maintaining one can be a lot of work. Once you start issuing shares to employees, they get complicated fast.

Fortunately, there are solutions to help. The main players in the cap table game right now are:

- Carta (this is what most of our clients use)

- LTSE Equity (formerly Captable.io)

- Shoobx

These tools can help you build a capitalization table and scale it with your startup through multiple rounds of funding and employee equity grants.

Then, it’s important to share your cap tables with your accountant. To work with a team that has extensive experience with cap tables, we’re here. Contact our startup-focused CPAs today.