Get up to $500k Back from the IRS with a Fixed-Fee, CPA-Run R&D Evaluation

Who performs more R&D than a tech startup? ShayCPA’s team of tech startup accounting specialists works with pre-seed, seed, and series-A founders to get back what you’ve earned through a federal R&D tax credit.

A wide range of startups qualify for a federal R&D tax credit. With it, you can reduce your tax liability by a certain percentage of everything you spent on R&D. If you’re performing what the IRS calls qualified research, you can get the credit for part of your researcher’s salaries, for the equipment you’re using, and even for your computing costs.

Plus, exploring these potential tax savings is no-risk when you choose ShayCPA. We set a fixed fee for your R&D study so you know exactly what to expect, and we won’t invoice you until your R&D credit is in the bank.

We are Certified Public Accountants (CPAs) that can handle both your R&D tax credit and your annual tax filings. If you’re looking for a one-stop shop for all of your startup’s needs, you’ve found it.

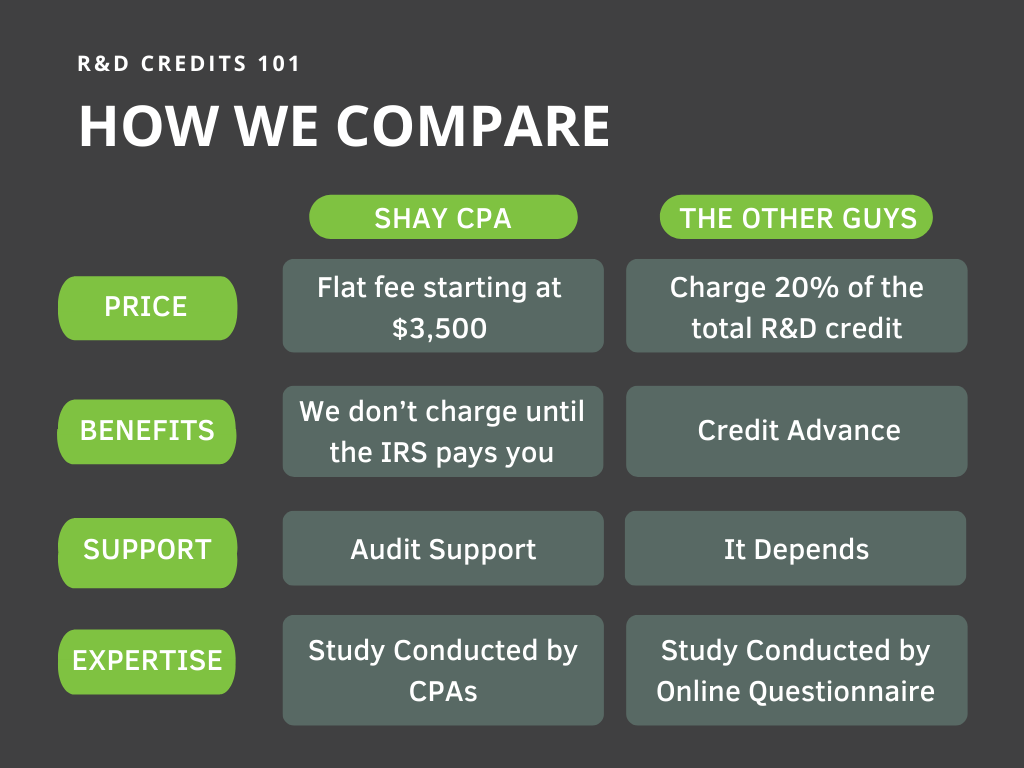

Side-by-side Comparison

Fixed-fee R&D credit studies

Nobody likes unknowns, especially when it comes to budget line items. So you don’t have any uncertainty, we charge a flat fee for our R&D evaluations. Plus, we’ve taken measures to ensure you get a solid bang for your buck. Take a look:

| ShayCPA | The Other Guys |

| Flat fee starting at $2,500 | Charge 20% of the total R&D credit |

| We don’t charge until the IRS pays you | Credit advance |

| Audit support | It depends |

| Study conducted by CPAs | Study conducted by online questionnaire |

Why Shay CPA

How it works when you choose us

We know that time is precious for any startup founder, so we’ve worked to streamline this process for you. Let’s walk through the steps:

Step 1: The R&D Interview

You sit down with one of our expert CPAs for 30 minutes. We’ll gather info about your work and your staff. If you want, we can also set up a GitHub import to add an extra level of audit support. This works through our partnership with RetroacDev, a R&D study platform.

Step 2: The Calculations

Don’t worry. This part is all on us. We’ll crunch the numbers, doing things like evaluating your payroll — including your pay to contractors — for relevant R&D associated payroll expenses. Long story short, we determine how much credit you should receive.

Step 3: The Paperwork

We’ve got you covered here, too. We’ll submit the proper paperwork to the IRS so you can get your credit. We’ll also get Form 6765 to your accountant so they can include it in your annual tax returns. (psst! We can handle those for you, too.)

Step 4: The Report

Once we’re finished, you’ll get a comprehensive R&D study report for your records. We’ll also advise you on anything else you should file away so you can be ready in the event of an audit.

Step 5: The Delayed Invoice

We know how tight cash flow can be for a startup. That’s why we don’t charge upfront for our R&D studies. Instead, you won’t see an invoice from us until your IRS credit is in the bank.

AUDIT GUARANTEE BY CPAs

We’ll help you in the event of an audit

Like we said, we try to keep as much of the work as possible on our own plate. And that doesn’t stop once we file for your R&D credit. We’re also available if you get audited.

Audits happen, and they don’t have to be a major source of stress. We come alongside you to make sure you’re producing the right paperwork and receipts so the IRS can confirm that everything checks out.

Here’s the main thing you need to know: you could be paying a lot more in taxes than you need. Most startups do some sort of qualified research, and that means they can claim a potentially hefty R&D tax credit. Don’t leave that money on the table.

Case Study

Runway ML

Runway is a Professional video editing software ecosystem that utilizes machine learning enhancing visual arts products with advanced tech for mainstream users.

How did Runway start? Like all success stories, in a college student’s garage. Ok, not entirely as an NYU student in 2018, Cristóbal Valenzuela didn’t have a garage when he came up with the idea for his thesis that would morph into a Series B company that would raise $35 million in 2021.

What are the core accounting concerns for a machine learning startup? For Runway, two of their major needs have been the R&D Tax Credit and Sales Taxes.

Runway now makes sales in multiple states that trigger sale tax reporting as a growing SaaS model business. Keeping track of their sales and new reporting requirements means ongoing reviews and hands-on analysis so they aren’t caught off guard.

When it comes to the R&D Tax Credit as a machine learning-driven company, it was a given that Runway would qualify, but the core question was when they should apply so they could earn the most benefit.

“Akshay, Kimberly, Jay, and the entire ShayCPA team has been a partner to Runway since the beginning. They have managed all of our monthly bookkeeping and necessary federal and state tax returns, while also handling additional, more specific matters such as R&D tax credits and state-specific sales tax filings. They have been responsive, flexible, and incredible partners to work with since our Seed round, and we have scaled with us even as we more than 6x’d the company.”