A remote workforce can deliver a whole host of benefits to employers, from reduced overhead to the ability to tap into a broader (and potentially more skilled) employee pool. It can also help boost employee satisfaction and support retention.

Prior to the pandemic, remote work was seen as a perk offered by a select few employers. Now, a recent poll showed that more than half of employees would prefer to be more remote than in-office. And if your tech startup worked out the biggest kinks in remote work through 2020, you might be particularly interested in giving some (or all) employees the opportunity to work from home.

This choice, though, comes with ramifications. Specifically, you need to decide which benefits you want to or are able to offer to remote employees. And to maintain productivity throughout your remote workforce, you should also consider ways to keep your staff motivated and engaged as they work from home.

To help your tech startup thrive with a remote workforce, let’s look at a few of the most pressing questions around this topic.

What benefits can you offer as an employer?

Generally, remote employees expect the same benefits as those who go into the office, particularly if they’re full-time. Here are a few areas where you should look into offering benefits:

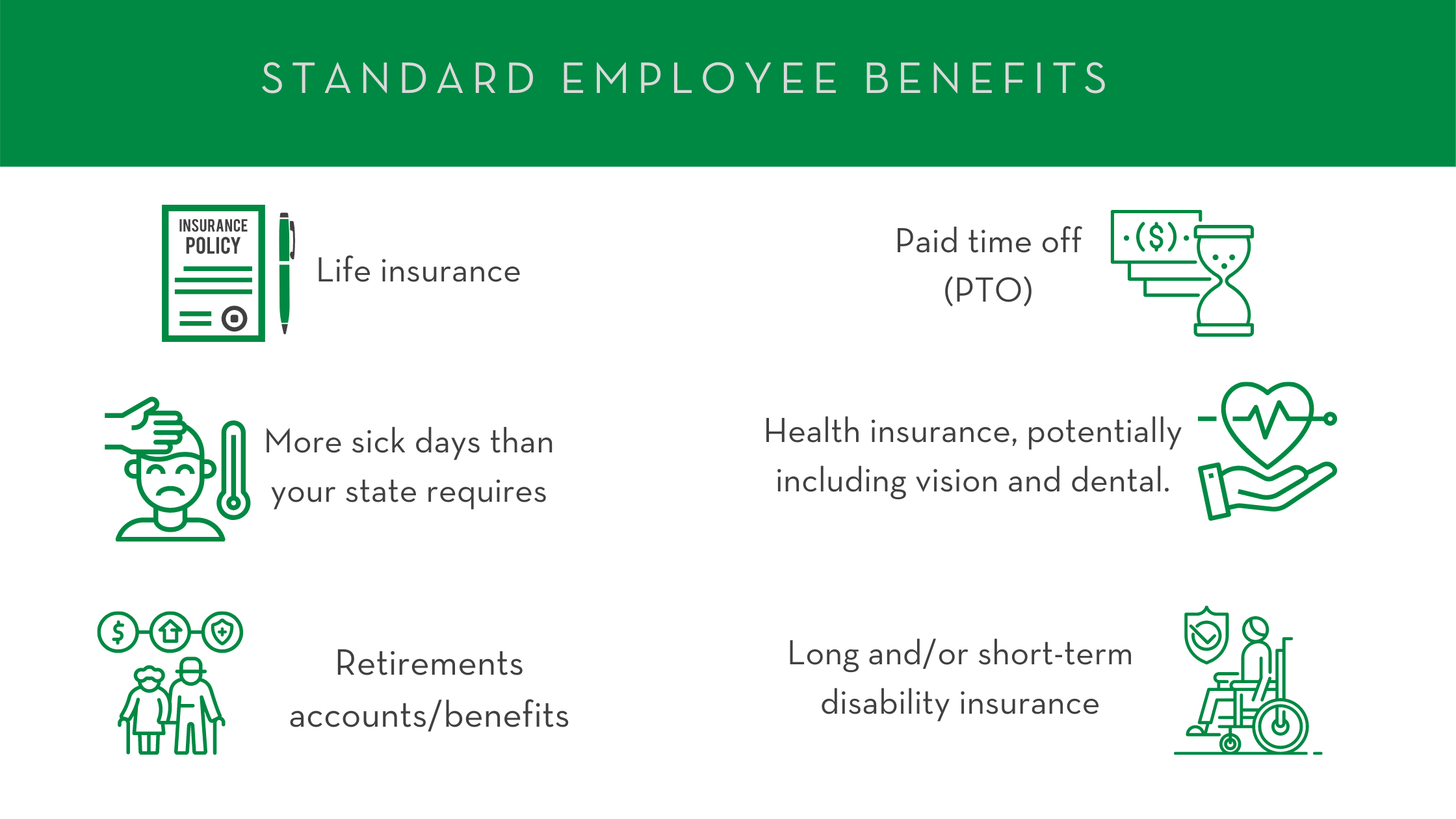

Standard employee benefits

You can offer your remote employees the same benefits you offer those who head into the office on a regular basis. That includes, but doesn’t have to be limited to:

In other words, remote employees can receive the same benefits as in-office staff.

You may want to consider the transferability of certain benefits, though. For example, if one of your workplace perks is access to a nearby gym, you might want to instead give remote workers a set stipend for the fitness expense of their choice.

Child care benefits

Employees with young kids at home often struggle to balance their work demands with the needs of their children — and understandably so. If you have concerns that your employees would be less able to focus or produce because of their children at home, you may want to explore some sort of child care benefits.

And because you can claim a tax credit on the child care your business provides, you may be able to offer this benefit to employees more easily than you may think.

Flexible hours

This can be a challenge for employers who already feel they’re giving employees a long leash by allowing remote work. But if your employee is at home, giving them flexible hours may encourage work at their peak productivity times, helping them get more done with a higher quality.

Home office supplies

Just a handful of years ago, employees could deduct the expenses associated with setting up a home office. Now, though, as a result of the Tax Cuts and Jobs Act of 2017 (TCJA), employees can no longer claim the miscellaneous deduction for home office expenses. That deduction was only eliminated through 2025, so there’s a chance this tax perk could come back eventually.

In the meantime, though, your employees may need some support getting their work-from-home space established. That could include desks, office chairs, printers, or — in our Zoom era — even something as simple as a webcam. By covering those costs for them, you can support their best work while remote.

Are remote work benefits tax-deductible?

In most cases, if a benefit is tax-deductible for an in-office employee, it’s deductible for the remote worker. That means the standard benefits you offer (like health care) still enjoy the same tax deductions, credits, or other benefits, no matter where your employee works.

Flexible hours don’t come with any tax benefits as you should still be paying the employee roughly the same amount.

That leaves two specific areas to explore:

- Child care benefits. These aren’t tax-deductible. Instead, you get a tax credit, which can help you save more money than a deduction. Per 26 U.S. Code § 45F, employers can claim a tax credit of 25 percent of any money they spend on qualified child care expenditures. You don’t have to build a child care facility at your business, either. You can claim this tax credit for the money you spend on contracts with a qualified child care provider. This tax credit caps out at $150,000 each year.

- Home office supplies. If you buy equipment (e.g., a desk) to help a remote employee establish their home office, you will generally be able to consider it a business expense. As with all business expenses, diligent recordkeeping will help you claim the maximal deduction.

Consider establishing an Accountable Plan:

An accountable plan is a plan that deals with employee reimbursements and follows IRS guidelines. Why must accountable plans follow IRS guidelines? Because reimbursements are not counted as part of the employee’s income and therefore not reported in W-2 documents. It’s in the best interest of you and your employees that a firm accountable plan is outlined and includes these IRS rules:

- An employee expense must have a business connection—that is, it must have paid or incurred deductible expenses while performing services as an employee of the business.

- An employee must adequately account to the company for these expenses within a reasonable period of time.

- An employee must return any excess reimbursement or allowance within a reasonable period of time.

How can you keep remote employees motivated?

A remote workforce needs the same level of care and attention that an in-office one does, if not more. Here are a few tips to help you keep your remote staff engaged and productive:

- Set them up for success. Working from home can have its challenges. Ask your employees what they need to do their best work. Benefits like child care or home office supplies can go a long way.

- Establish clear goals. Many employers struggle with remote work because they feel it’s harder to track employees’ productivity. To minimize this issue, it can be helpful to set clear expectations and specific deadlines. If, say, an employee is working on a large-scale, long-term project, you can ask for weekly updates that show that specific, pre-set benchmarks are being hit. Finding some way to keep those goals visible (e.g., a project management software with a dashboard view) can help to keep everyone on the same page.

- Stay in touch. It’s easy for remote employees to feel disconnected. Regular check-ins — both in the form of one-on-one contact and group meetings (like a weekly team Zoom happy hour) — can help to keep them plugged in. Additionally, regular anonymous surveys can help you keep a finger on the pulse of satisfaction among your remote employees.

Ultimately, remote workers can deliver substantial benefits to your company — but they do require some special consideration. If you want support understanding the tax ramifications of your remote workforce or where you can claim tax credits and deductions for the benefits you offer them, contact our team at ShayCPA today.