By: Kacie Goff

When you’re launching a startup, the tax-deductibility of certain meals and entertainment can be particularly exciting. You need to eat, after all, so it seems like a pretty sweet deal that you might reap some tax benefits there.

The trick, though, is that deductions for meals and entertainment vary from situation to situation, and regulation around both deductions has changed in recent years.

The last thing you want is to find out that those pricey steak dinners you’ve enjoyed all year are actually not tax-deductible. And since the Consolidated Appropriations Act (CAA), which was signed at the tail-end of 2020, changed how these deductions get handled for the 2021 tax year, this is a timely subject.

To help you get a better handle on when meals or entertainment might be tax-deductible for your tech startup, let’s look at both categories separately. (Spoiler alert: you’re not going to like the news we give you about entertainment deductions.)

Meal deductions for 2021

As we mentioned before, the CAA changed how businesses can write off their meal expenses this year. Specifically, the CAA enacted the Taxpayer Certainty and Disaster Tax Relief Act of 2020 (TCDTRA).

Historically, businesses had been able to deduct 50 percent of the cost of business meals with clients. But thanks to the TCDTRA, starting on January 1, 2021, and continuing through the end of the year, you can now deduct 100 percent of the expense of business-related food and beverages — provided you purchase the meal from a restaurant.

This change is intended to serve as a support to the restaurant industry. As a result, it specifically excludes grab-and-go food, like what you buy at grocery and convenience stores, and any eating facilities your business operates, even if you contract a third party to run them.

Additionally, the IRS says explicitly that meals qualify for this 100 percent deduction only when “the expense is not lavish or extravagant under the circumstances.”

And this is just scratching the surface of the specific parameters around what qualifies as a tax-deductible business meal. For starters, you need to be present with the client; you can’t simply hand them your credit card. You also shouldn’t expect this deduction to extend to any family or friends you invite to the meal.

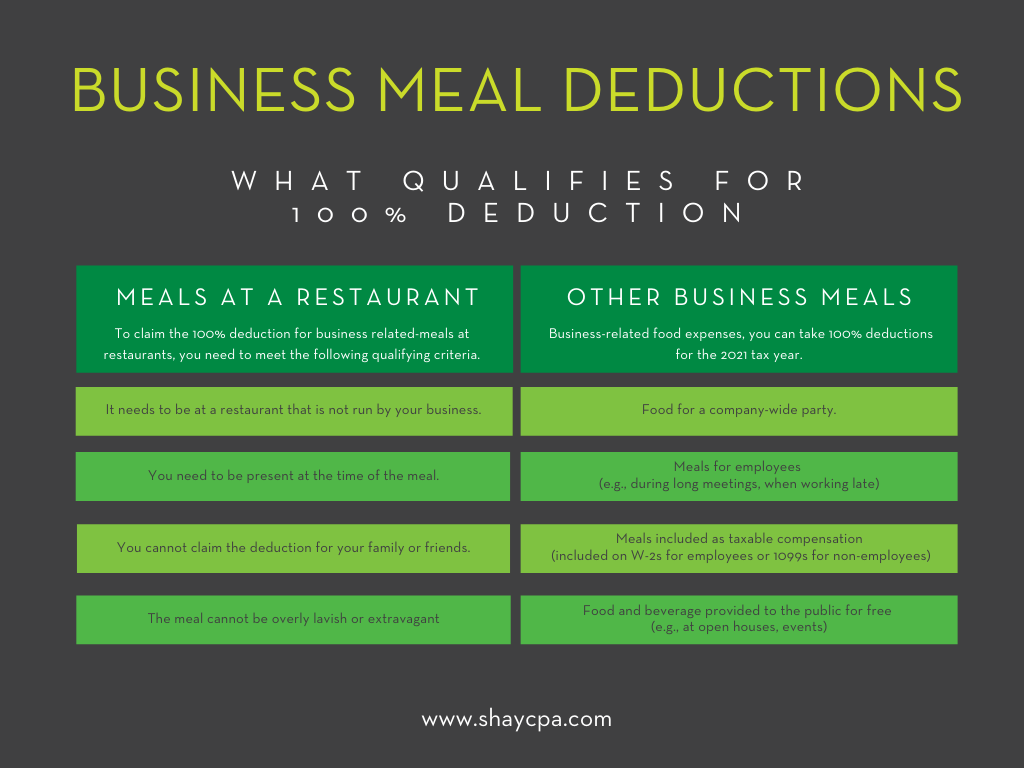

Long story short, in order to claim the 100 percent deduction for business related-meals at restaurants this year, you need to meet the following qualifying criteria:

- It needs to be at a restaurant that is not run by your business

- You need to be present at the time of the meal

- The meal cannot be overly lavish or extravagant

- You cannot claim the deduction for your family or friends

The good news? The 100 percent deduction is exactly what it sounds like: a deduction for all of your qualified business meal expenses. That means it covers both food and beverages, along with sales tax and tips.

Other food-related deductions

Meals with clients are just one example of potential meal deductions your tech startup can claim. You can also generally deduct restaurant-purchased food that you provide for your employees and meals when you or one of your employees are on a business trip. And thanks to the TCDTRA, a lot of those deductions clock in at a full 100 percent deduction for the 2021 tax year.

Here’s a quick look at all of the 100 percent deductible business-related food deductions you can take for the 2021 tax year (in addition to restaurant meals with clients):

- Food for a company-wide party

- Meals for employees (e.g., during long meetings, when working late)

- Meals included as taxable compensation (included on W-2s for employees or 1099s for non-employees)

- Food and beverage provided to the public for free (e.g., at open houses, events)

- Business meals while traveling or at conferences

You also get a write-off for office snacks and drinks, although only 50 percent of that expense is tax-deductible.

Now, you should have a pretty good idea of when you can get a tax benefit for food and beverage purchases. But what about those tickets you were planning to buy a client for an upcoming ballgame or the latest zero-gravity flight experience?

Entertainment deductions

While you used to get a tax deduction for taking clients to an entertainment experience, the Tax Cuts and Jobs Act (TCJA) of 2017 did away with that. Specifically, you can no longer claim a deduction for “activities generally considered entertainment, amusement, or recreation.”

So if you planned to take a client out for dinner and a show, don’t expect any tax perks associated with the latter. That also means the cost of tickets to sporting events, concerts, and other entertainment experiences need to come out of your own pocket (or your business’s) in their entirety.

Maximizing your meal deductions in 2021

While the IRS has extended the 100 percent deduction to food purchased at restaurants for business purposes, they have yet to issue guidance on what, exactly, constitutes a restaurant. We know convenience stores don’t count; there are certainly some gray areas here. Does the IRS classify food carts/trucks as restaurants? What about bars and airport lounges?

In lieu of a statement from the IRS clarifying their definition of a “restaurant,” it’s probably in your best interest to choose locations that are definitively restaurants for any upcoming client or prospect meetings.

As with all tax write-offs, recordkeeping is critical in ensuring you can claim the deduction. At each restaurant, make sure you get an itemized receipt and file it somewhere safe (digital receipts can make this easier). As you save the receipt, make sure you notate how much you left as a tip since that amount can be included in your deduction.

Ultimately, this year presents an exciting opportunity to reduce your tax liability by 100 percent of your business-related meal expenses. But it’s important that everyone at your tech startup understands what food expenses can count toward this deduction and the proper recordkeeping protocols, too.

That’s where we come in. As certified public accountants (CPAs) who specialize in services for tech startups, we can help you make the most of your meal write-offs in 2021. For guidance on recordkeeping, clarification on what can count toward this deduction, or other tax support to help your startup thrive, get in touch.