Among the provisions under the Coronavirus Aid, Relief, and Economic Security (CARES) Act, we would like to introduce these two topics that may be helpful to you: Unemployment Assistance and Recovery Rebates.

Unemployment Assistance

There are three new Unemployment Insurance (UI) Programs created by the CARES Act:

- Pandemic Unemployment Compensation (PUC)

- Pandemic Emergency Unemployment Compensation (PEUC)

- Pandemic Unemployment Assistance (PUA)

These programs are fully funded by the federal government and the States will also receive additional administrative funds to operate these programs.

We will be introducing these programs in a broad manner based on the information provided in this Fact Sheet from the National Employment Law Project. Please visit this fact sheet if you would like to know more details for each UI Program.

Pandemic Unemployment Compensation (PUC)

From March 27, 2020, the date the bill is signed into law, through July 31, 2020, all regular UI and PUA applicants will receive $600 per week in compensation in addition to their usual calculated benefit. It may be paid with the regular UI payment or at a different time, but it will be paid on a weekly basis.

Pandemic Emergency Unemployment Compensation (PEUC)

An additional 13 weeks of state UI benefits will become available after the applicants exhaust all their regular state UI benefits. Most of the states will offer 26 weeks of UI benefits except the following:

- Arkansas

- Alabama

- Florida

- Idaho

- Kansas

- Missouri

- North Carolina

- South Carolina

To be eligible for PEUC, applicants must be actively engaged in searching for work. The CARES Act does provide that a State is obligated to provide flexibility in meeting such requirements in case of individuals unable to search for work because of COVID-19, including reasons of illness, quarantine, or movement restriction.

The States are also obligated to follow the “Non-Reduction Rule” in the CARES Act, which suggests that they may not do anything to decrease the maximum number of weeks of UI or the weekly benefits available under state law of as January 1, 2020, as long as they are participating in these programs.

Pandemic Unemployment Assistance (PUA)

Pandemic Unemployment Assistance (PUA) provides emergency unemployment assistance to workers who are left out of regular state UI or who have exhausted their state UI benefits. PUA will be available to workers who are immediately eligible to receive PUA for up to 39 weeks. This program will expire on December 31, 2020, unless otherwise extended.

You will be eligible for PUA if you are a:

- Self-employed worker

- Independent Contractor

- Freelancer

- Workers seeking part-time work

- Workers who do not have a long enough work history to qualify for State UI

If you are eligible for State UI, you will not be eligible for this PUA Program.

Applicants for PUA Program will need to provide self-certification that they are partially or fully unemployed, or unable and unavailable to work due to one of the following circumstances:

- They have been diagnosed with COVID-19 or have symptoms of it and are seeking diagnosis;

- A member of their household has been diagnosed with COVID-19;

- They are providing care for someone diagnosed with COVID-19;

- They are providing care for a child or other household member who can’t attend school or work because it is closed due to COVID-19;

- They are quarantined or have been advised by a health care provider to self-quarantine;

- They were scheduled to start employment and do not have a job or cannot reach their place of employment as a result of the COVID-19 outbreak;

- They have taken over the head of household role because the previous head of household has died as a direct result of COVID-19;

- They had to quit their job as a direct result of COVID-19;

- Their place of employment is closed as a direct result of COVID-19; or

- They meet other criteria established by the Secretary of Labor

It’s important to know that workers who can either telework with pay or are receiving paid sick days or paid leave are not eligible for PUA.

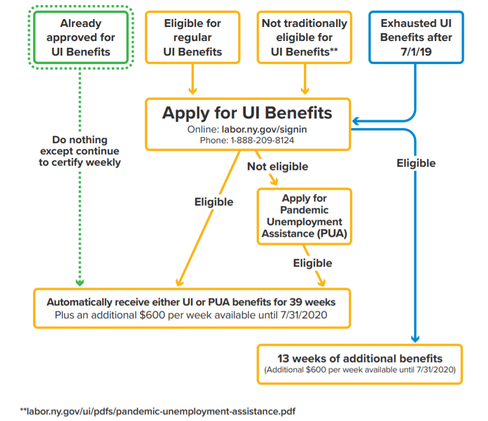

This graph provided by the New York State Department of Labor provides a good summary.

For New Yorkers filing for unemployment see details below:

Important Information for Unemployment Insurance Claimants:

The CARES Act was enacted on Friday, March 27, 2020. Please see the CARES Act web page for information about how the Act may affect UI benefits. Please do not call if you already have a UI claim; it will only make it difficult for others to reach an agent.

Information regarding the CARES Act and other COVID-19 updates will be posted in the Frequently Asked Questions about Unemployment Insurance During the Coronavirus Emergency.

If you are filing a new Unemployment Insurance claim, the day you should apply is based on the first letter of your last name.

A – F file on Monday | G – N file on Tuesday | O – Z file on Wednesday

Missed your day? File on Thurs-Fri-Sat

Any claim you file will be backdated to the date you became unemployed. If you are eligible, you will be paid for all benefits due.

Department of Labor is extending telephone filing hours as follows:

Monday through Thursday, 8 am to 7:30 pm.

Friday, 8:00 am to 6:00 pm.

Saturday, 7:30 am to 8:00 pm.

2020 Recovery Rebates for Individuals

In addition to Unemployment Benefits, the CARES Act also provides Recovery Rebates, also known as the Stimulus Checks, for individuals. Because the distribution of the Stimulus Checks will be coming from the Internal Revenue Service (IRS), the IRS will use 2019 tax forms to determine how much and where to send the checks. If 2019 tax forms have not yet been filed, the IRS will use 2018 tax forms to determine.

Treasury Secretary Steven Mnuchin said that Americans should start getting these checks within three weeks, however, according to NBC News, some experts believe that with the budget cuts and the outdated technology, it may take up to months to distribute the checks. Another factor that will also delay the receiving of the check is change of address after previously filed tax forms. People whose address have changed after filing their tax returns will need to submit a change of address form to the IRS which can take up to 4 to 6 weeks to process. But for those who have set up direct deposit as the method of refund on their previously filed tax return, they can get the check a little bit sooner than those who elected for paper checks.

The IRS does not have my direct deposit information. What can I do? In the coming weeks, Treasury plans to develop a web-based portal for individuals to provide their banking information to the IRS online so that individuals can receive payments immediately as opposed to checks in the mail.

The IRS does not have my direct deposit information. What can I do? In the coming weeks, Treasury plans to develop a web-based portal for individuals to provide their banking information to the IRS online so that individuals can receive payments immediately as opposed to checks in the mail.

The amount of the Stimulus Check one can receive will be based on the previously filed tax return of how much they’ve made. See below for the thresholds:

- Single taxpayers who’ve made less than $75,000 will receive $1,200

- Taxpayers filing as Head of Household who’ve made less than $112,500 will receive $1,200

- Married taxpayers filing a joint return who’ve made less than $150,000 will receive $2,400

If taxpayers have any dependent, they can receive an additional $500 per child with no limitation on the number of children. And if the taxpayer’s income is higher than the above threshold, then the amount received will be reduced but not below zero, by 5 percent of the amount exceeding the thresholds.

In order to be eligible for the Stimulus Check, an individual cannot be one of the following:

- A nonresident alien;

- A dependent; and

- An estate or trust

As a result, many high school/college students may not be eligible.

For individuals who have not filed a tax return since 2018, the IRS will use the following 2019 forms to determine the amount and address for the Stimulus Check:

- Form SSA-1099, Social Security Benefit Statement or

- Form RRB-1099, Social Security Equivalent Benefit Statement

Once the Stimulus Check has been distributed, a notice will be sent by mail to the taxpayer’s last known address no later than 15 days. The notice will indicate the method of distribution (by direct deposit or paper check), the amount distributed, and a phone number for the appropriate point of contact at the IRS to report any failure to receive such payment.

For FAQ published by the IRS regarding the stimulus checks please see link here.

Tax Relief – Federal Income Taxes

In addition to the CARES ACT, there will be automatic extensions to file and pay Federal Income Taxes until July 15, 2020. Such extensions apply to individuals, partnerships, and corporations. There will be no interest or penalties, but it does not apply to gift, estate, payroll, or excise taxes. First quarterly estimated payments that are due April 15th will be applicable. Most states will likely follow and New York State is confirmed to be one of them.