Running a tech company requires you to keep a lot of plates spinning. You might not feel like you have time for financial planning and analysis (FP&A) — but you need to make time.

Without proper budgeting and forecasting in place, you’re flying blind. You need a budget to track your business’s spending so you can reign in potentially problematic areas, and you need a forecast to make sure you’re on the right track. Without both, you could find yourself facing unexpected expenses without the cash balance or incoming revenue to keep things afloat.

That’s a dire situation, and you might feel like you’re far from that becoming a reality. Even so, the right budgeting and forecasting models can help your tech company thrive by giving you the data you need to make informed decisions moving forward.

To help your company see financial success now and in the future, we rounded up our top budgeting and forecasting tips.

Build assumptions

A budget is certainly a helpful tool for tech companies, but you shouldn’t stop there. Assumptions give you a robust, informed way to look forward. They’re a great place to build a useful forecast for your tech company.

As a quick refresher, financial assumptions are exactly what they sound like: assumptions about your company’s future finances. Basically, assumptions give you a way to build a single worksheet where you can continually forecast future revenue and expenses.

As your overarching business projection, your assumption worksheet should include any and all A/R and A/P line items. Generally, tech companies can break this into two areas:

Revenue assumptions

If you operate on a subscription-based model, it should be fairly easy for you to project future revenue based on the number of subscriptions you currently have. Just make sure you factor in your historic rates of growth and churn. Also include any other revenue streams, like add-ons or charges for additional customer support.

If your business sells its products or services on a one-off basis, creating your revenue assumptions will be a bit more challenging. Still, though, you can turn to historic data here. Even if your business is new, you can research growth in other similar tech companies to give you a ballpark idea of where you’re likely headed.

Again, assumptions are just that: assumptions. They’ll get more accurate as your business has more historic data to use to inform them. But even in their early phases, revenue assumptions play an important role, helping you track cash flow and growth opportunities.

There’s another component of your assumptions worksheet to consider.

Expense assumptions

While you can’t absolutely predict all of your business’s future expenses, you can make fairly educated assumptions here based on your current outlay. Some areas to consider include:

- The cost to lease your business location

- Utilities for that space

- Cloud/computing/software costs

- Salaries

- Consumables (like printer ink/paper)

- Marketing and advertising costs

- Taxes

- Insurance

- Company vehicles

- Equipment purchase or rentals, including IT equipment

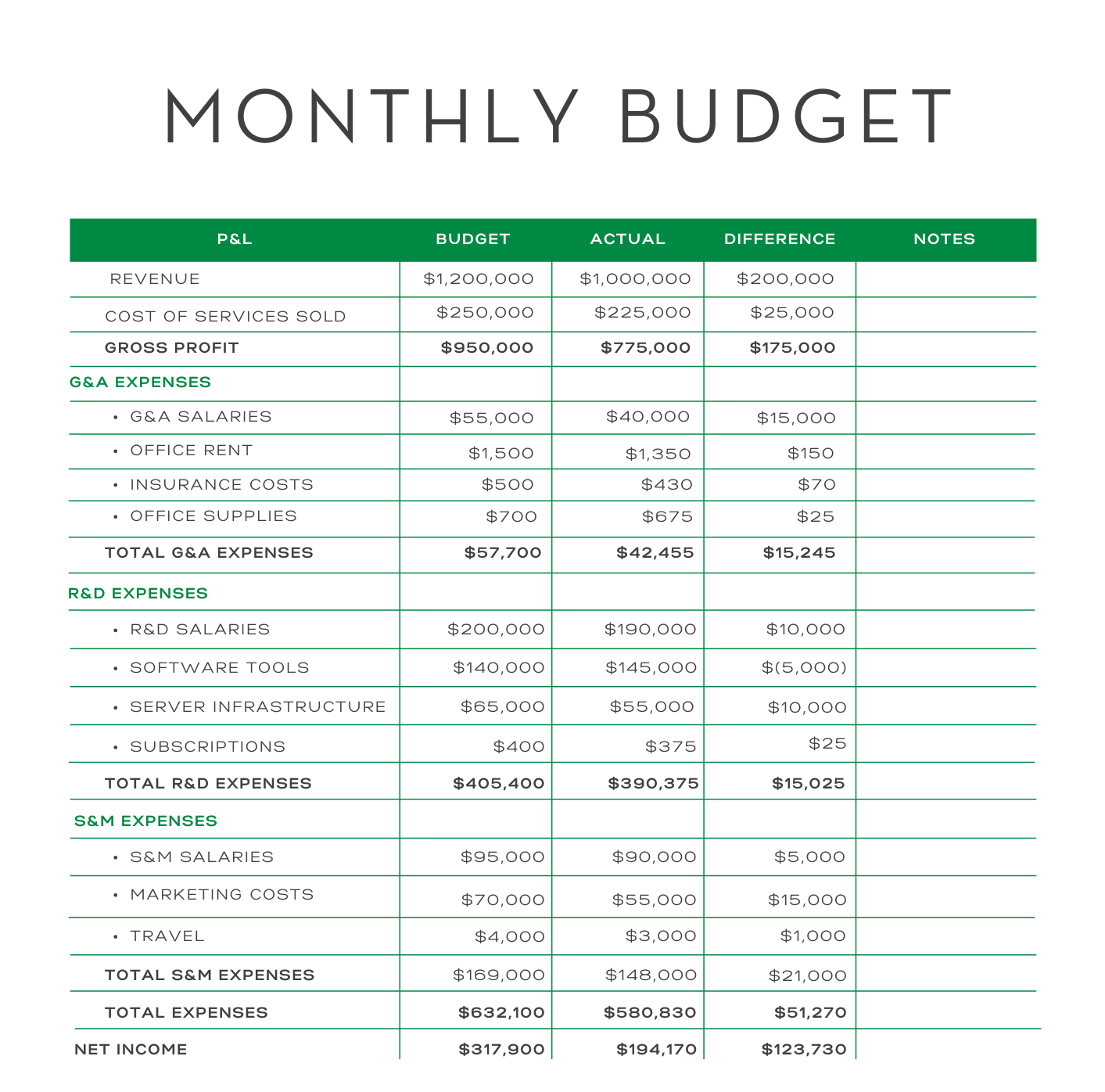

Clearly, there’s a lot to consider. Your budget is a great place to start. Every category within your budget should be captured in your expense assumptions.

Other considerations for assumptions

A couple more things to factor in when building assumptions:

- Seasonality and shorter months: While most tech companies aren’t subject to the seasonality of, say, a retail business, you should still monitor your month-over-month revenue and expenses so you can adjust your assumptions accordingly.

Also, if you’re making revenue assumptions per business day, don’t forget to plan for the different number of business days in different months. This is particularly important during the end-of-year holiday season.

- Adaptability: Make your assumptions clear and adaptable. In other words, as you’re building out your assumptions, label everything so that any person on your team could take a look at the data and quickly understand what’s going on. As your tech company grows, this will become increasingly important.

Also, use formulas wherever possible so your assumptions can adjust as needed. Don’t, for example, put in a set sum for your assumed income tax; make sure it’s a calculation based on the assumed income. That way, as you update figures in your assumptions based on new data, the entire worksheet can track with you.

Track, then calibrate

With all of your budgeting and forecasting tools, including your assumptions, you can’t apply a set-it-and-forget-it mentality. Tech is an industry that changes particularly quickly, and your financial tools will only continue to be useful if you regularly hone them.

Find the right calibration frequency for your unique business. Some tech companies benefit from monthly reviews of budgets and assumptions, while others only need such a review quarterly. Either way, put a recurring time on your calendar to make sure you’re circling back to give your financial data a careful analysis. That’s the best way to spot potential issues, like a steady creep up in spending in one budget category or a revenue assumption that isn’t reflective of your current income.

Regular review also helps to ensure that your tech company doesn’t find itself up against a wall. For example, it can help you keep ample cash reserves when you know you have a big quarterly estimated tax payment coming up.

Build a better toolbox

This may go without saying for companies in the tech industry, but it’s so important that we’ll double down here: seek out the right tools for your business. Excel probably isn’t going to cut it long-term. And the right financial tools can automate a lot of the budgeting and forecasting tech companies need to thrive, making your life easier.

The ideal financial tools depend on your business’s specific needs, but we can recommend a couple of options worth checking out: Fathom and Jirav can both support and streamline your financial modeling.

Employ the Three Statement Model

Your budgeting and forecasting shouldn’t live in different silos. That’s where the Three Statement Model can come in. This tool is so useful it deserves its own focus, so we’ll deep dive into it in our next blog.

For now, though, if you want any support for your tech company’s budgeting and forecasting — whether that’s help building assumptions or the perfect financial tech stack — we’re here.