Founders, for 2021, the threshold to issue a 1099-NEC remains $600 for payments made in the calendar year 2021. You must issue a 1099-NEC to the following:

- Services performed by someone who is not your employee (including parts/materials) – (box 1)

- Payments to an attorney (box 1)

If you just started your tech company in 2021, it’s great practice for you as a business owner to start collecting a W9 form (link) from all contractors your business decides to work with. This would include any software developers that are not employees, graphic designers, lawyers, accountants, and any other vendors that your company begins to work with. The W9 is a one-page form that collects basic information about the vendor that you are paying. This includes name, address, federal tax classification (Sole Proprietor, C-Corp, S-Corp, Partnership, etc.), and either the social security number or employer identification number. This information is then used to prepare the 1099’s.

For those founders who have dealt with issuing 1099’s, ensuring that the W9 forms you have collected from your contractors are up to date is critical. Most of our tech clients use payroll/PEO services like Gusto, Justworks, or Rippling to pay their employees and contractors. Although these services will issue 1099’s for any payments made through their platform, they won’t include any payments made outside of it. This means that analysis will need to be done to review any additional vendors that you may have paid via wire transfer or ACH during the year. For tech companies, we find that this often is the case for payments made via bill.com and large wire transfers to law firms when a fundraising round (Seed, Series A, Series B, etc.) has closed.

The deadline for the 1099-NEC forms for 2021 is January 31st, 2022.

Below is a draft 1099-NEC form for 2021.

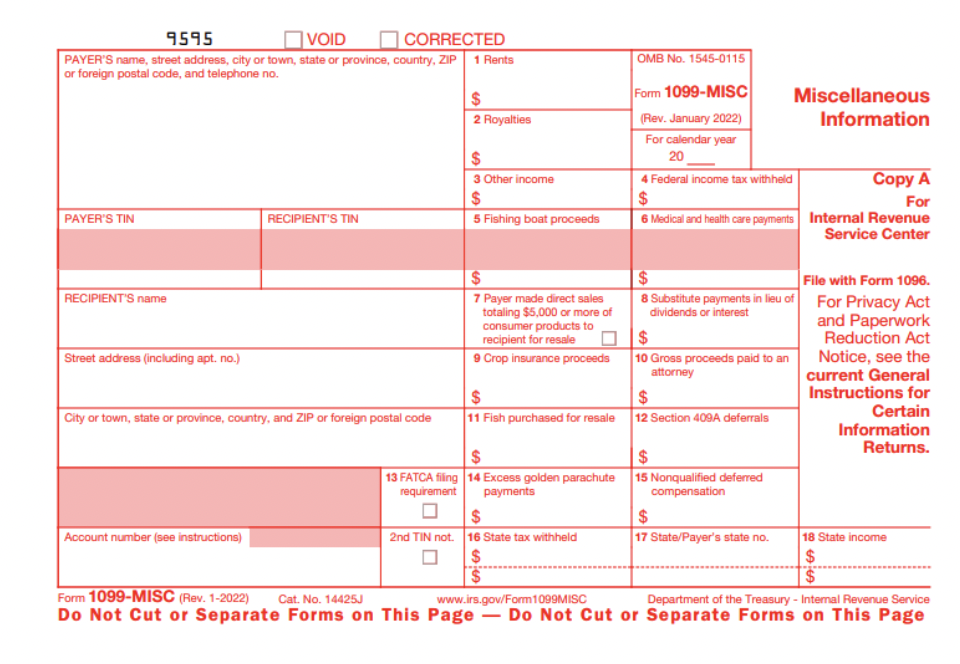

The 1099-MISC forms were previously used instead of 1099-NEC; however, the 1099-NEC is now used exclusively for contractor payments.

Your company may still have a requirement to file 1099-MISC forms if you pay for any of the following payment types.

- Rents (box 1);

- Prizes and awards (box 3);

- Other income payments (box 3);

- Generally, the cash paid from a notional principal contract to an individual, partnership, or estate (box 3);

- Any fishing boat proceeds (box 5);

- Medical and health care payments (box 6);

- Crop insurance proceeds (box 9);

- Gross proceeds paid to an attorney (box 10)

- Section 409A deferrals (box 12); or

- Nonqualified deferred compensation (box 14).

The following thresholds apply.

- Greater than $600 payment.

- At least $10 in royalties or broker payments in lieu of dividends or tax-exempt interest

The tax deadline for 1099-MISC is generally January 31st, with a few exceptions. More detailed information can be found directly on the IRS website. See link.

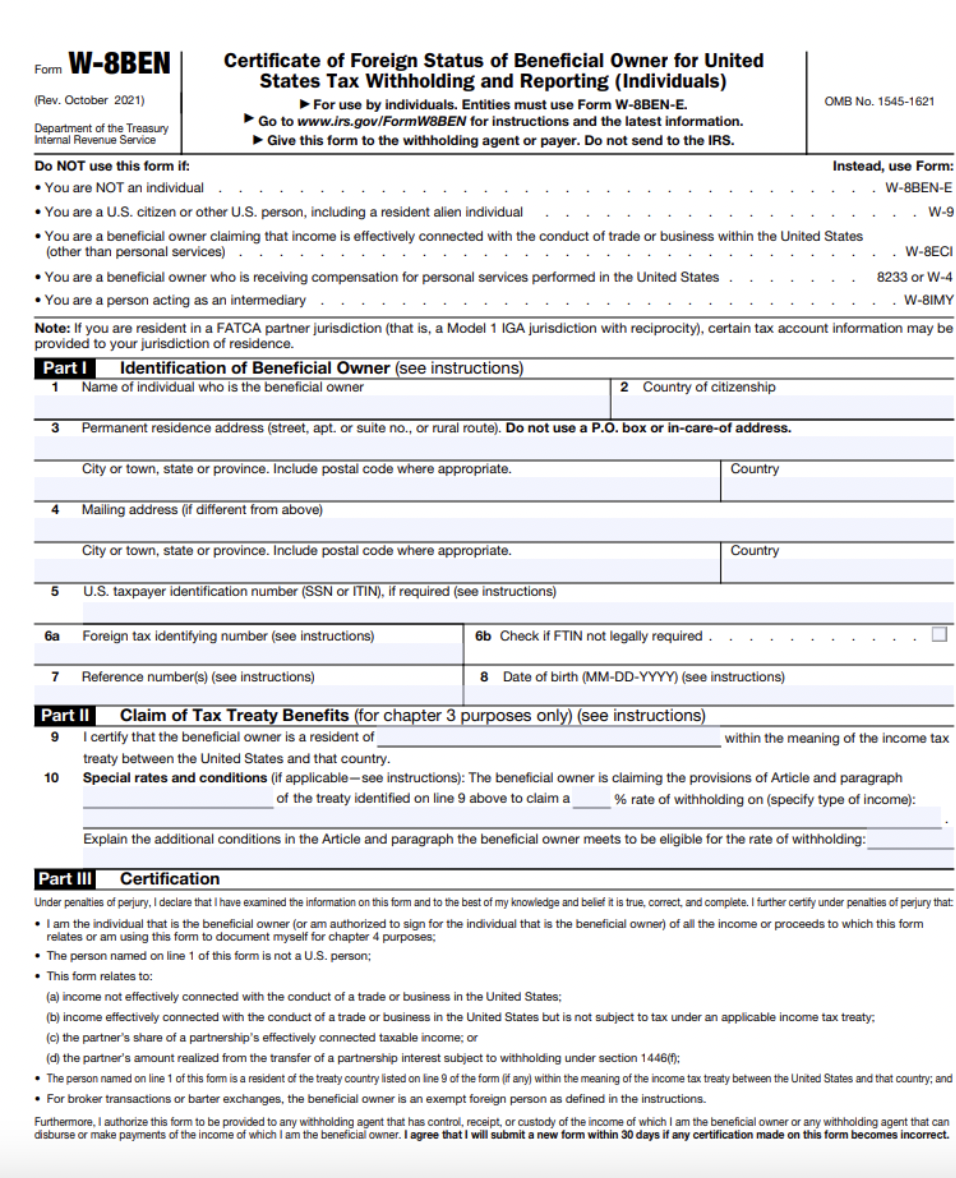

Paying Foreign Contractors

If your tech company is paying foreign contractors, it may help to understand whether any of the income could be considered U.S. Source income. It’s helpful to have all your foreign contractors complete Form W8-BEN to ensure compliance with tax treaties and 30% foreign withholding requirements. Depending on the type of entity you are paying overseas, there are various W8 Series forms that may apply. See link here for more information. A 1042-S may need to be issued to foreign vendors where withholding is required. See more information here.

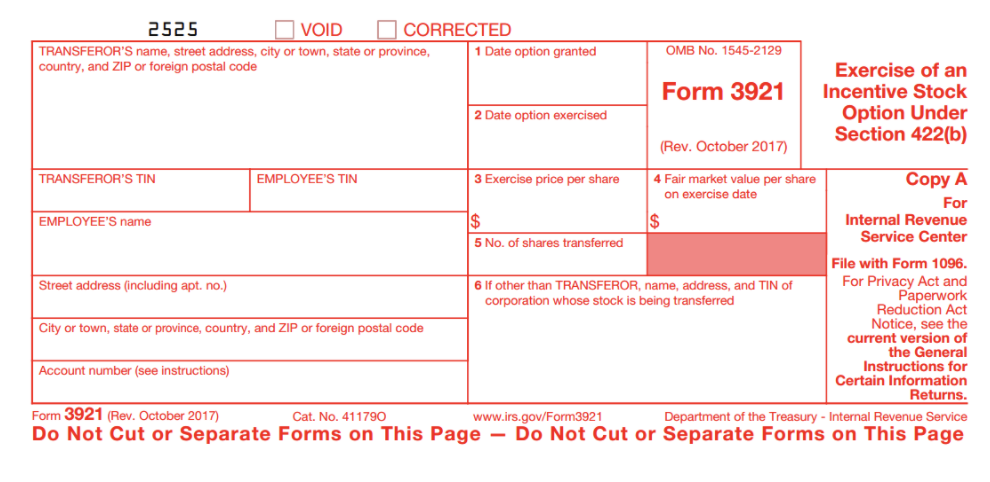

Incentive Stock Option Exercises

If your startup had ISO (Incentive Stock Option) exercises during the year, these would also need to be reported on Form 3921 by February 1st to recipients and March 31st to the IRS. Some services like Carta may offer assistance with preparing these forms; however, your company’s responsibility is to make sure they are filed on time.

If your tech company uses the IRS FIRE system – This year, there are some changes to the FIRE system to take note of. Please find more information on this here.

If your tech company needs to report any exercised 83, (b) non-statutory stock options, these will need to be reported on Form W2 (Box 12, code V). There is a helpful Gusto article that explains this in further detail.

As ever, we love working with founders to help take away the pain of onerous reporting requirements, so feel free to reach out if you have any questions.